For many Australians, paying by card is second nature, with the thought of paying in cash or by cheque a distant memory. For businesses, the increase in card and other touch payment methods has resulted in an increased need for good merchant services such as EFTPOS machines and online payment systems in order to ensure that revenue keeps rolling in.

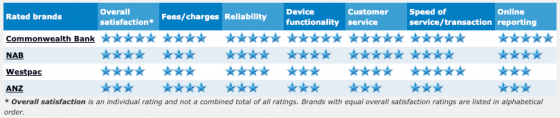

While essential, deciding which type of merchant services to use might be a daunting task to tackle, with plenty of options available to choose from, adding to the often very long list of ‘to-dos’ when starting or running a business. That’s why Canstar Blue produces an annual review of the big banks and the services they provide Australian business. More than 700 business owners and decision makers took part in our latest review, with banks rated on a number of categories relating to factors including customer support, costs, transaction speed, reliability and reporting.

The big banks were rated in the following order for overall business customer satisfaction with merchant services:

It is the third time in four years that ANZ has topped the table for overall satisfaction, climbing back to the top after being displaced by Commonwealth Bank in 2017.

With more than three quarters (78%) of businesses always sticking with the same service provider – and spending nearly $400 a month on merchant services, the survey found – shopping around will surely be a wise move. Even if you’re happy with the service as a whole, it doesn’t hurt to consider what else is on offer, it could just save your business some time, effort and money.

Here is a quick guide to merchant services, what drives customer satisfaction, and some of the other key findings from our latest survey:

Merchant service fees are made up of several fixed and variable components. The fees are usually based on the number of transactions that are made over the month and can vary between types of businesses. As an example, CBA publishes the following fees that may apply to your business:

With plenty of fees to watch out for, be sure to read the fine print before you sign on the dotted line for a new system or terminal.

Here is a guide to the services offered by the big banks:

A popular option for many businesses, ANZ has returned to the winner’s circle, offering plenty of options, regardless of your type of business. As ANZ is a major bank, its merchant services are compatible with a wide range of cards, including VISA, MasterCard and American Express.

For those after EFTPOS and Point of Sale (POS) Systems, ANZ offers a number of machines and terminals that can keep you up to date with customers. Categorised into Standalone and Integrated systems, ANZ can help regardless of how you operate.

Standalone models include the ANZ FastPay for tap and go payments, the POS Turbo 2 for counters and the wireless POS Mobile 2 for those on their feet all day, while the Integrated product range consists of the BladePay, POS Turbo Plus and Mobile Plus. ANZ lists the cards accepted with each system, as well as whether each system is compatible with Wi-Fi and 4G systems, ensuring that you choose the right model for your business.

For those looking to operate via online payments, ANZ also offers a number of options, including Secure Gateway, eGate and PayID. ANZ’s Secure Gateway provides a way for consumers to safely pay online, or through the ANZ app, with options for scheduled payments for regular customers. The Gateway can also be purchased in a packaged deal, with a Phone package and Phone & Web package available for those who also take phone orders.

eGate offers an option for businesses which offer a shopping cart setup on their online business, with ANZ also hosting online payments so that you don’t have to worry about storing sensitive customer card data, giving both parties peace of mind.

Commonwealth Bank offers businesses a number of ways to keep the money rolling in, with a number of EFTPOS and eCommerce options to suit all business types and industries. For brick and mortar businesses, CBA has four EFTPOS options, all available on a fixed rate monthly plan to ensure there aren’t any surprises when it comes to the bill.

The bank’s first option is Albert, a plan that includes a 7inch Android tablet. Compatible with MasterCard, Visa, American Express, as well as Apple Pay and Android Pay, Albert includes additional features such as bill-splitting, making it helpful for those in hospitality and dining. Albert provides 3G and Wi-Fi capabilities, meaning you can take the tablet with you as you move around the shopfloor, as well as connection ports for your current POS system.

CBA also offers Leo, a plan suitable for those who predominantly deal with smartphone tap payments. It features a barcode reader for those with coupons or QR codes and also supports both iOS and Android systems, making it accessible for the majority of consumers. Card holders aren’t forgotten however, with Leo also similarly built to handle the traditional PIN and card insertion transactions.

For those after something more compact, Emmy may be the option for you. Emmy uses Bluetooth to pair with the CommBank Small Business app to turn your smartphone into a handy payment tool. Through the pairing, customers can pay in a variety of ways, including bank transfer, BPAY, as well as card.

If you’re after something for online transactions, CBA offers a number of exclusive products in addition to the traditional BPAY and PayID options. Each option can be customised to suit your personal preferences or business type, with an application process available via the bank’s website.

Westpac similarly offers both physical and online merchant services, including EFTPOS and POS options for small businesses.

Westpac’s sole trader option, Genie, is a mobile payment terminal that allows consumers to pay either through the Westpac Genie App or from a physical card reader. With no monthly account fee, or minimum term contract, businesses only pay for the transactions they take. If you’re new to Westpac, you’ll be set up with a transaction account, along with online banking capabilities to help you manage your financials.

Westpac offers EFTPOS terminals, including the EFTPOS 1 and Presto Smart for all those card transactions. Similar to Genie, the bank’s EFTPOS terminals have no minimum contract term, with a number of options available to suit your transaction amount. For those looking for something a bit extra, Westpac also offers the EFTPOS 1i, with the package more suitable for PC EFTPOS services.

The Presto Smart is Westpac’s integrated option, with the EFTPOS terminal helping businesses to connect their POSS to payment terminals. It comes with a selection of terminals to suit your type of business. The full list of capabilities and compatible services are listed on Westpac’s website, so be sure to read through the fine print if you’re not sure what will suit your business best.

For online businesses, or businesses that simply support online transactions, Westpac offers PayWay and BPAY options, including Virtual Terminals for more established enterprises. PayWay is available through a number of options, including Net and Phone, allowing businesses to be able to take orders and payments over the phone and online, in addition to opening up a number of accepted card and payment types.

NAB may not offer the widest range of merchant services for businesses compared to some of the other big banks, but still has enough to make sure that you don’t miss out on making sales. Available in a variety of plans, NAB’s EFTPOS Mobile terminal accepts all of the major credit cards, including Visa, MasterCard, UnionPay and American Express.

Each NAB terminal can be used for either mobile or counter use, with 3G and Wi-Fi capabilities, making it easy for both customers and businesses. Additional payment terminals can be added to your plan, but it will cost you, so be sure to check the fine print before you line up a package. All plans also incur a monthly NAB Connect fee, allowing businesses to utilise NAB’s online banking.

For online options, NAB offers NAB Transact, which allows businesses to process online, phone and mail order payments, making it a worthwhile option regardless of whether you operate out of your own home, or out of an office. The NAB Transact option also includes 12 months of reporting, scheduled payment options as well as added security for consumer peace of mind.

NAB also offers the eCommerce Merchant Account, giving businesses freedom with a choice of gateway provider and overnight settlement. The choice will come down to your personal preference and how much turnover you expect your business to bring in on a monthly basis.

With plenty of options available, merchant services will be as unique to a business as the business itself, with monthly transactions, business size and budget all factors to consider before lining up the products best for your enterprise.

With 66% of surveyed businesses stating that the majority of transactions go through EFTPOS facilities, researching into merchant service types and providers can not only help your revenue stream but also customer experience as well.

This report was written by Canstar Blue’s Home & Lifestyle Content Lead, Megan Birot. She’s an expert on household appliances, health & beauty products, as well as all things grocery and shopping. When she’s not writing up our research-based ratings reports, Megan spends her time helping consumers make better purchase decisions, whether it’s at the supermarket, other retailers, or online, highlighting the best deals and flagging anything you need to be aware of.

Canstar Blue commissioned Colmar Brunton to survey 1,630 Australian adults across a range of categories to measure and track customer satisfaction. The outcomes reported are the results from customers within the survey group who currently have a merchant service provider from a bank to take payments from customers – in this case, 753 people.

Brands must have received at least 30 responses to be included. Results are comparative and it should be noted that brands receiving three stars have still achieved a satisfaction measure of at least six out of 10. Not all brands available in the market have been compared in this survey. The ratings table is first sorted by star ratings and then by mean overall satisfaction. A rated brand may receive a ‘N/A’ (Not Applicable) rating if it does not receive the minimum number of responses for that criteria.

2017

2016

2015

2014