KEY POINTS

- Solar rebates are a government-backed financial initiative designed to reward individuals and businesses for generating their own energy through solar power.

- Solar rebates function as a discount scheme for households that install a renewable energy system, or a sustainably-powered hot water system.

- There are two national government solar rebate initiatives available in Australia: the Small-scale Renewable Energy Scheme and solar feed-in tariffs (FiTs).

In this article, Canstar Blue explains the solar rebates currently available to Australian households.

On this page:

Advertisement

What is a solar rebate?

Solar (PV) systems provide limitless free energy from the sun’s radiation and are undoubtedly the best small-scale renewable energy source for Aussie households. Unfortunately, solar systems are expensive to buy and install, which is where the Australian Government’s rebates come into play.

Solar rebates are a government-backed financial initiative designed to reward individuals and businesses for generating their own energy through solar power. Initially introduced to encourage the adaptation of solar panels, these rebates help offset the substantial upfront costs, which can be a barrier for many potential buyers. By reducing the financial burden, these rebates make solar systems more accessible and appealing to homeowners and promote the expansion of solar energy across Australia’s grid.

Although the size and scope of rebates have decreased over time, there are still several incentives available for households and businesses looking to invest in solar power.

How does a solar rebate work?

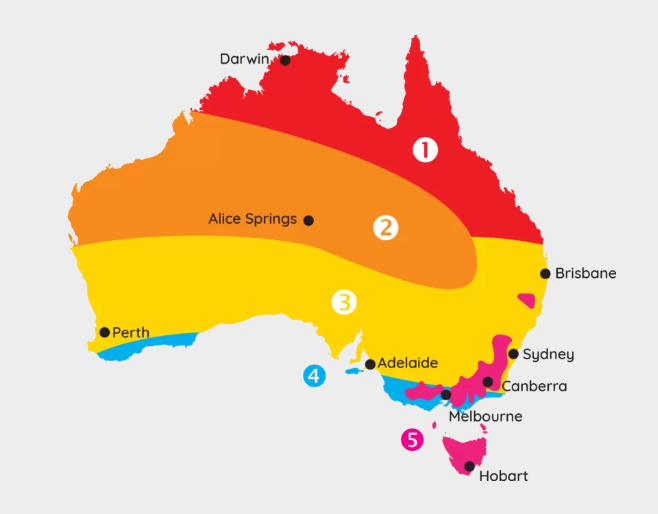

In Australia, solar rebates function as a discount scheme for households that install a renewable energy system, or a sustainably-powered hot water system. While technically more of a financial incentive than a rebate, this system operates similar to a voucher system. Homeowners receive a certain number of vouchers based on the size of their system and geographical location of their home. These vouchers can be exchanged or sold to reduce the upfront cost of their solar system installation. This initiative is known as the Small-scale Renewable Energy Scheme.

What are the government solar rebate initiatives available in Australia?

There are currently two national government solar rebate initiatives available in Australia: the Small-scale Renewable Energy Scheme and solar feed-in tariffs (FiTs).

Small-scale Renewable Energy Scheme

The biggest and monetary incentive run by the government is the Small-scale Renewable Energy Scheme. Under this scheme, customers who install an eligible small-scale renewable energy system, such as rooftop solar panel systems under 100 kilowatt hours (kW), can earn what is known as a small-scale technology certificate (STCs).

What are STCs?

STCs are calculated based on the amount of renewable energy the system will generate. One certificate is equal to one megawatt hour of renewable electricity. Generally, these certificates are sold on a customer’s behalf by their solar installer to recoup a portion of the overall installation costs.

Customers can also sell these certificates themselves through an open market or through what is known as the ‘STC Clearing House’. However, it should be noted that both of these options can take up to 12 months to come into fruition.

The value of a STC will vary depending on the climate of the area you reside and install your solar in. As shown on the map pictured above, climate zones for STCs are broken up into four regions. It is important to note that while this is a government-run scheme, it does not play any part in setting the price of these certificates, nor does it pay back the money earned from STCs to consumers. For more information on small-scale energy certificates, it’s recommended to visit the Clean Energy Regulator’s website.

Feed-in tariffs (FiTs)

The second major incentive (although perhaps more of a subsidy) is the government’s solar feed-in tariffs. This is a small rebate of a few cents for each kilowatt hour (kWh) of unused electricity generated by your solar system that is exported into the electricity grid. Some states have mandated minimum FiT rates, but generally, retailers are free to set their own rates as long as they meet these minimums. Since FiTs are governed by state policies, rates vary depending on where you live. For a full list of solar FiTs in Australia, visit our best solar tariff page, or explore our state-based pages below.

Household Energy Upgrades Fund

Although it’s not a rebate, Australians looking to upgrade the energy efficiency of their home may have access to discounted finance products from participating lenders. This includes solar PV systems, batteries and inverters, and solar hot water.

The Household Energy Upgrades Fund is available to homeowners, rental property owners, and strata properties, although eligibility requirements apply. More information is available at the Clean Energy Finance Corporation’s website.

How do I sign-up to a solar rebate?

To receive small-scale energy certificates, you will generally need to have a discussion with your solar installer prior to the installation process to determine the costs and number of certificates applicable in your circumstance.

Some states and territories also run specific rebate schemes for households that purchase and install certain renewable energy technologies, such as solar batteries or solar hot water systems. To apply for these, you’ll generally need to go through your government’s website.

As for FiTs, these are generally applied once connected to the grid, but you can get access to a higher tariff by comparing plans from different electricity providers. Keep in mind, while some electricity plans have a higher FiT, they could include higher usage costs for general electricity. So, be careful to always read the fine print.

Solar plans in Australia

Here are some solar specific energy plans currently available in Australia. To find your state’s plans, click on the correct tab at the top of the table.

Here are some of the cheapest solar-specific deals from the retailers on our database. These costs are based on the Ausgrid network in Sydney but prices will vary depending on your circumstances. We show one product per retailer, listed in order of lowest price first. Annual price estimates assume general energy usage of 3900kWh/year for a residential customer on a single rate tariff. Price estimates exclude solar feed-in tariff credits. These are products from referral partners†. Our database may not cover all deals in your area, and please check retailer websites for up to date information.

Here are some of the cheapest solar-specific deals from the retailers on our database. These costs are based on the Citipower network in Melbourne but prices will vary depending on your circumstances. We show one product per retailer, listed in order of lowest price first. Annual price estimates assume general energy usage of 4000kWh/year for a residential customer on a single rate tariff. Price estimates exclude solar feed-in tariff credits. These are products from referral partners†. Our database may not cover all deals in your area, and please check retailer websites for up to date information.

Here are some of the cheapest solar-specific deals from the retailers on our database. These costs are based on the Energex network in Brisbane but prices will vary depending on your circumstances. We show one product per retailer, listed in order of lowest price first. Annual price estimates assume general energy usage of 4600kWh/year for a residential customer on a single rate tariff. Price estimates exclude solar feed-in tariff credits. These are products from referral partners†. Our database may not cover all deals in your area, and please check retailer websites for up to date information.

Here are some of the cheapest solar-specific deals from the retailers on our database. These costs are based on SA Power network in Adelaide but prices will vary depending on your circumstances. We show one product per retailer, listed in order of lowest price first. Annual price estimates assume general energy usage of 4000kWh/year for a residential customer on a single rate tariff. Price estimates exclude solar feed-in tariff credits. These are products from referral partners†. Our database may not cover all deals in your area, and please check retailer websites for up to date information.

State-by-state solar rebates

There are further rebates for sustainable electricity use that aren’t limited to solar. Different states offer incentives for things such as energy-efficient appliances, running your pool filter at off-peak times, efficient air conditioning systems and many more – all can be found on the government’s energy savings website. Keep in mind that rebates aren’t restricted to solar panels – you can also get a rebate on small-scale wind turbines, solar and heat-pump hot water, or even hydro power systems.

Solar rebates in NSW

Despite NSW’s original Solar Bonus Scheme ending in December 2016, and its Rebate Swap for Solar ending in 2024, the state still offers some financial incentives to households who contribute to renewable energy generation, in addition to competitive FiTs.

Battery and VPP rebates

NSW residents can claim a discount for batteries and Virtual Power Plants (VPP) from accredited installers and suppliers. Current schemes include:

Battery installation incentives

Customers installing a new solar battery from an accredited supplier can claim a discount based on the usable capacity of their battery. Discounts range between $700 and $1,150 for a 6.5 kWh battery, and $1,600 and $2,400 for a 13.5 kWh battery. More information is available from solar installers in your area.

Virtual Power Plant incentives

Eligible customers with solar batteries can earn a rebate when joining a VPP with an Accredited Certificate Supplier. Rebates are available from $120 to $190 for a 6.5 kWh battery, and $250 to $400 for a 13.5 kWh battery, and can be claimed twice. Accredited suppliers include Creditex, EC Focus, Ecovantage and Electric Future Sustainability Services.

Smart Distributed Batteries Project

Eligible customers in selected council areas can claim a $4,950 discount on a Tesla Powerwall 2 when joining a VPP. Participating councils include Shoalhaven City, Eurobodalla Shire, Bega Valley Shire, Queanbeyan-Palerange, Yass Valley, Snowy Monaro and Goulburn Mulwaree. More information is available from battery installers in these areas.

Solar rebates in VIC

Victoria also has a selection of solar rebates available to households, the most notable ones being the Solar PV Panel Rebate, Solar Battery Loan and Solar Hot Water Rebate. Feed-in tariffs in Victoria are also regulated by the government, with providers required to offer a minimum tariff of 4.9c/kWh.

Solar PV panel rebate

This program offers a rebate of $1,400 on the installation of solar PV panels for homeowners and rental properties. An interest-free loan equivalent to their rebate amount is also available to Victorians through this program. This loan however, must be paid off within four years.

To be eligible, Victorian residents must own their home, not have an existing solar system installed in the last 10 years and have an annual combined household taxable income of less than $210,000. Properties valued at over $3 million are not eligible for this rebate.

Solar battery loan

The VIC Government also offers an interest-free loan up to $8,800 on the installation of a solar battery for homeowners.

To be eligible, VIC residents must own their home, have an existing solar system equal to or greater than 5kW, have an annual combined taxable household income of less than $210,000 and not have received a rebate or previously received a solar battery rebate. The energy storage system purchased must also be listed on Solar Victoria’s approved list of products and have a capacity equal to or greater than 6kWh to be eligible for the discount. Properties that already have an existing battery system in place cannot use this loan on the purchase of an additional battery. Households have four years to pay off this loan.

Solar hot water rebate

There is also a rebate of up to $1,000 available to Victorian residents who wish to install a solar hot water or heat pump hot water systems on their property.

To be eligible, residents must own their home, have a combined taxable household income no greater than $210,000, not have a received a rebate as part of the PV panel or solar battery scheme, have a hot water system that is at least three years old and occupy a property under the value of $3 million.

Solar rebates in QLD

Unlike other states, QLD doesn’t offer a major solar rebate. Instead, residents can benefit from FiTs. Surplus energy produced by a customer’s solar power system can be exported back to the electricity grid, instead of being stored in a battery for later use. The customer may then receive a payment for this excess energy, which is known as a feed-in tariff.

Since there is no set government rate for electricity sent back to the grid, retailers offer competitive, market-based rates. This makes it important to shop around for the best deal. SEQ residents will likely receive a market-set feed-in tariff. For regional Queenslanders, a regional feed-in tariff is largely available.

It’s important to note that the Solar Bonus Scheme FiT is no longer available to new customers. Customers already on the Bonus Scheme will receive a 44c/kWh feed-in tariff until 1 July, 2028.

Solar rebates in SA

South Australia has since ceased its solar rebates in recent years. However, there are still a number of solar feed-in tariffs, specialty solar programs and Virtual Power Plant (VPP) programs in the state.

Solar rebates in WA

Western Australia doesn’t currently offer any additional solar rebates to homeowners outside of those offered nationally. It does, however, run a time of export buyback scheme for those that own solar panels, batteries or an electric vehicle. This scheme is known as the Distributed Energy Buyback Scheme (DEBS) and financially rewards consumers for sending back energy to the grid during peak and off-peak times.

The buyback rate varies for Synergy and Horizon Power customers, but generally households in WA can expect to earn around 10c/kWh at peak times and around 2c/kWh – 3c/kWh at off-peak times for sending renewable energy back into the grid. For more information visit the WA Government’s website.

Solar rebates in TAS

Tasmania is another state with limited solar rebates in Australia. But with a FiT of between 8-10c/kWh offered from most retailers and the national STC program, solar lovers down south can still make a small return off their solar investment, without the assistance of rebates.

Solar rebates in NT

Like other states, the Northern Territory offers a solar battery install rebate program. The Home and Business Battery Scheme provides homeowners and businesses in the NT with a rebate of $400 per kilowatt hour of usable battery capacity, up to a maximum of $5,000. This rebate can be applied to the purchase and installation of a solar battery for either a new or existing solar panel system.

To be eligible for this rebate, you must be a home or business owner in the NT. If you happen to own both a home and business, you can apply for this rebate to both of your properties. Keep in mind, this is a solar battery rebate and the concession cannot be used to purchase a solar panel system alone. The chosen solar battery must also be listed on the NT Government’s list of approved batteries. For full terms and conditions visit the government’s website.

Solar rebates in the ACT

Australia’s capital currently has one interest-free loan option and one solar rebate program available to households: the Sustainable Household Scheme and Home Energy Support program.

Sustainable Household Scheme

With the Sustainable Household Scheme, eligible homeowners in the ACT can borrow between $2,000-$15,000 as part of an interest-free loan to go towards energy-efficient upgrades in the home.

Some of the eligible products to be purchased under this program include:

- Rooftop solar panels

- Household battery storage systems

- Electric heating and cooling systems

- Hot water heat pumps

- Electric stove tops

- Electric vehicles (EVs) and charging infrastructure

Residents can purchase one of more of the following products under this program so long as the total expenditure is under $15,000. This rebate operates in partnership with financial institute Brighte, and residents have 10 years to repay their interest-free loan. In addition to meeting the scheme’s eligibility, ACT residents are also required to attend an hour-long live online workshop hosted by Brighte to access this program. The full terms and conditions can be found on the ACT Government’s Climate Choices website.

Home Energy Support Program

This program allows eligible concession holders to receive up to $5,000 in rebates for energy-efficient upgrades in the home, including rooftop solar. Residents can access up to $2,500 to help with the installation of solar panels, with a further $2,500 up for grabs if they also install reverse cycle heating and cooling, hot water heat pumps or ceiling insulation.

To be eligible, residents must hold a Pensioner Concession Card, a Department of Veterans’ Affairs (DVA Gold Card) or Australian Government Health Care Card. Residents must also own the property they reside in and their property must have an Unimproved Value (UV) at or below $750,000. They’ll also need to attend a free Everyday Climate Choices workshop.

More information on any of these rebates, including full terms and conditions, can be found on the ACT’s Climate Choices website.

Is it worth getting a solar rebate?

The variety of solar rebates on offer in each state and territory have dwindled in the past few years. But that being said, there are still some great solar rebates and buyback schemes open to most homes and businesses across Australia. When you take into account the large financial investment required from buying a solar panel system or energy storage unit, any amount that you can get in return will probably be worth looking into.

If you’ve exhausted all your rebate options, your best bet for making a return on your investment will be ensuring that you are on an energy plan that offers a decent solar feed-in tariff. Some retailers are more popular than others in the solar feed-in tariff space, offering higher returns and plans more suited to the needs of a solar customer.

Click the Canstar Blue link below to compare energy providers that are rated best for customers with solar panels.

Compare Best-Rated Solar Providers

Original reporting by Simon Downes

Image Source: alex.go_photography/Shutterstock.com

Share this article