The Australian Communications and Media Authority (ACMA) is introducing tough new telco rules to protect Australians from SMS scammers.

Developed in partnership with industry body Communications Alliance, the new rules will require telcos to identify, trace, and block text messaging scams. The all-new Reducing Scam Calls and Scam Short Messages Industry Code is a response to the increasing prevalence of SMS scams, which according to the ACMA account for about 32% of all reported scams in 2022 to date.

Beginning July 12, Australian mobile providers will need to comply with the updated industry code, or face potential penalties of up to $250,000. In addition to blocking scam numbers, telcos will now need to publish information to assist customers to identify, manage and report SMS scams, and share information about SMS scams with other providers. Telcos will also be required to report identified scams to authorities.

The updated code will complement the ACMA’s newly-introduced SIM-swap scam rules, which came into effect on June 30. The ACMA has made fighting SMS and telco scams a top compliance priority for 2022-2023, with ACMA Chair Nerida O’Loughlin stating that telco vigilance will lead to increased customer protection.

“There is no silver bullet to stop scams, but we know enforceable laws can have a significant impact and every blocked scam is a win for consumers,” said Ms O’Loughlin.

“The harder we make it for scammers, the less Australians are likely to be targeted.”

SMS scam losses more than $6.5 million in 2022

According to the ACCC’s Scamwatch, financial losses from SMS scams alone have increased by an astonishing 188% year-on-year. Scamwatch reported around $2.3 million was lost to text scammers in the first half of 2021, but this has grown to $6.5 million in 2022.

“These scam messages are deeply frustrating to Australians because they are received on devices that are an essential part of our social and economic lives. Almost every Australian adult and business is affected,” said Ms O’Loughlin.

“We shouldn’t have to screen messages and adopt workaround behaviours to be able to feel safe and stay connected.”

The ACMA is hopeful that tougher rules will see a repeat of the success of 2020’s Reducing Scam Calls code, which led to a dramatic drop in scam call complaints in the first 16 months after its introduction. The new rules will also build upon last year’s amendments to the Telecommunications (Interception and Access) Act, which proposed the use of advanced technology such as artificial intelligence to better identify and block scams at the telco level.

Earlier this month, Telstra confirmed that its own SMS scam-stopping platform had blocked more than 185 million malicious texts since its April launch. This includes impersonation and phishing scams, as well as malware sent via SMS. The telco reports that while the insidious ‘FluBot’ text scam has now been shut down, Australians are still at risk from scammers sending fake job offers, fake ATO and toll scams, and fake links to financial institutions.

How to spot an SMS scam

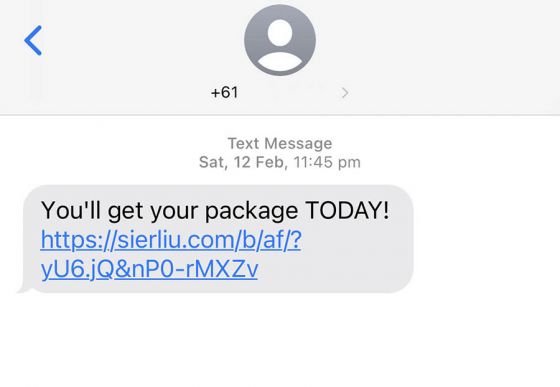

If you have a mobile phone, it’s almost guaranteed you’ll receive a scam SMS at some point. These scams include text messages that are designed to steal your personal information, infect your device with malware, or trick you into making a call or sending a text that will cost you a large amount of money. Here’s some of the key signs of a scam SMS:

- An unexpected SMS from an unfamiliar number asking for personal information.

- An SMS that asks you validate your details, collect a prize, accept a job offer etc. by clicking a link.

- An unexpected SMS from an overseas number, or one beginning with 19 or 190.

- Any unsolicited text messages that promise something too good to be true, such as money, a job or a prize.

- An unsolicited text message claiming to be from a legitimate organisation, such as a bank or the ATO, that includes suspicious links.

If you do receive a dodgy SMS, you should immediately delete the message — don’t reply, don’t call the number, and don’t click any links.

What to do if you’ve been scammed

If you think you’ve been targeted by an SMS scammer, and have disclosed personal info or clicked through any links, you’ll want to take the following action.

- Do not enter any passwords or log into any accounts, especially online banking or services such as Centrelink.

- Contact your bank or financial institution immediately to report the scam. Your bank may be able to stop or reverse a transaction, and close your account or credit card to stop future theft.

- Contact IDCARE online or by calling 1800 585 160. This is a free, government-funded service that can support you through identity theft if your personal info has been stolen.

- Change any online passwords that may have been compromised, including banking, email, social media, etc.

- In the case of SIM-swap and porting scams, you should also contact your mobile provider.

- You may also wish to report the scam to the ACCC here.

Share this article