More Australians are switching to smaller NBN providers in 2022 — and upgrading to faster speeds as the ‘big four’ broadband sellers see a slightly declining market share.

The Australian Competition and Consumer Commission (ACCC) has dropped its newest NBN Wholesale Market Indicators Report, which examines trends and changes in the wholesale NBN market. The ACCC’s latest research shows that in the June 2022 quarter, small telcos continued to gain market share, and also expanded their presence at the physical locations where networks can connect to the NBN.

Small NBN names continue to gain ground

The Wholesale Market Indicators Report looks at the relationship between NBN Co and the internet service providers that sell NBN plans to homes and businesses. While it doesn’t measure how telcos supply NBN to customers, assessing the wholesale market can offer a good indication of the plans and providers that are most popular with Australian broadband users.

According to the ACCC, smaller telcos — that’s brands operating outside the umbrellas of major companies Telstra, TPG Group, Optus and Vocus Group — account for 1,099,307 NBN services as of June 2022. Compare this to June 2020, when small brands operated 653,931 services, and it’s obvious that as the NBN roll-out wraps up, more Aussies are looking to smaller competitors for better deals.

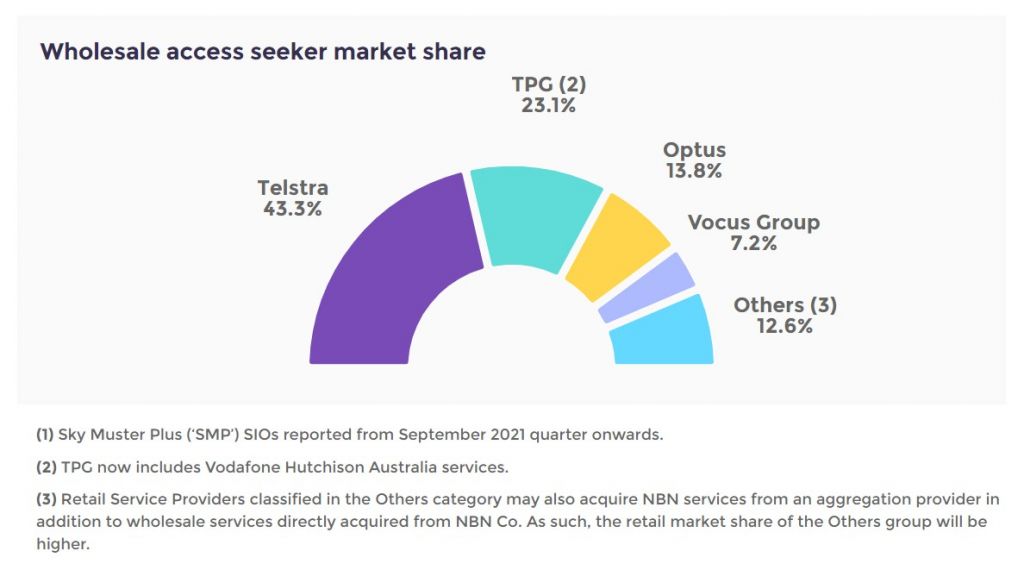

Small providers increased their market share by 0.8 percentage points this quarter, and now account for 12.6% of services. Popular telco Aussie Broadband was a significant contributor to the rising growth, increasing its own market share to 6.4% (a jump of 0.3 percentage points since last quarter).

In comparison, wholesale market shares have fallen for the industry’s biggest names. While Telstra is still the dominant player with a 43.3% share, this is down 0.4% from the previous quarter. The TPG Group (which includes TPG as well as Vodafone, iiNet, Internode, and Westnet) was down 0.2 percentage points to 23.1%, while Optus sits at 13.8% (down 0.1%). Vocus (Dodo and iPrimus) was also down slightly, dropping o.1 percentage points to claim 7.2% of the wholesale market.

“The growth of smaller providers is increasing the competitive tension in broadband markets, and many Australians will see the benefit of that,” ACCC Commissioner Anna Brakey said.

“Consumers have a wide range of choice for their broadband retailer, which enables them to choose the product that best suits them.”

The ACCC also found that more providers were now connecting directly to all 121 NBN Points of Interconnection (POI), which are the locations where an internet provider’s own backhaul networks connect to the NBN. In June 2022, at least 17 NBN providers were now using all 121 POIs, up from 13 in the previous quarter.

Aussies still feel need for speed with NBN 50 most popular

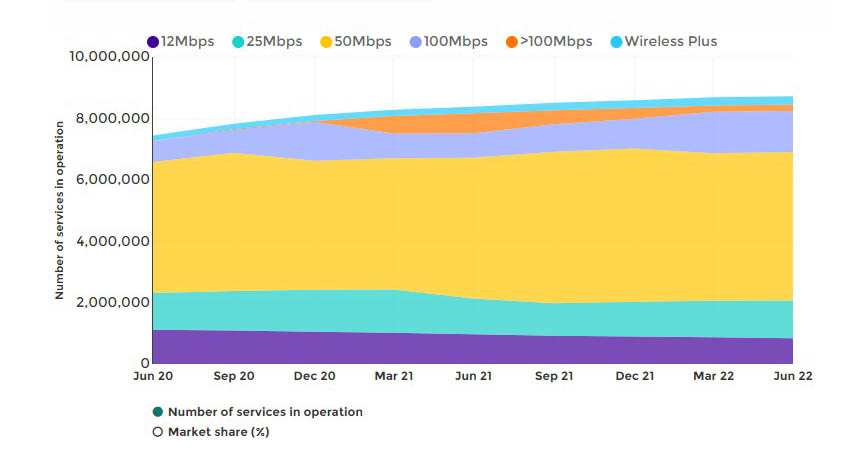

Australians continue to stick to faster plans, with 6.4 million of services on speeds of 50Mbps or faster — that’s around three-quarters of customers on fast plans. The total number of services as of June is 8.7 million, up 0.4% from the previous quarter, and CVC per user (Connectivity Virtual Circuit, or how much bandwidth is allocated to each NBN user) is now 2.8Mbps, up 2.4%.

NBN 50 (or Home Standard speed) still remains the most popular NBN speed tier hands-down, and accounts for 4,836,307 connections. Coming in second is NBN 100, aka Home Fast, which services 1,338,309 connections, followed by the slower NBN 25/Home Basic II speed at 1,226,207 services.

“The popularity of the higher speed tiers means that retail competition for these customers is strong, so we recommend that consumers regularly check for new offers or newly discounted deals,” Ms Brakey said.

After experiencing a drop in service in late 2021, very fast NBN plans with downloads between 100Mbps and 1000Mbps are again on the rise, growing from 206,577 connections in March to 209,476 connections in June. The initial drop-off was likely due to introductory discounts for new customers expiring, meaning many subscribers opted to switch back to cheaper and slower plans rather than pay full-price for extra-fast speeds.

However, with more homes eligible to upgrade to fast Fibre to the Premises connection types, high-speed plans are becoming increasingly more available, which may hopefully lead to more competitive pricing down the line to entice customers to stick around long-term.

For now, there’s still a huge range of new-customer offers available for NBN 50 and NBN 100 plans, with smaller names leading the charge in lowering monthly prices. Telcos currently running six or 12-month discounts on selected plans include Telstra, Optus and TPG, along with challenger brands Tangerine, Flip, Southern Phone, MyOwn Tel and Exetel (which also came first in the ACCC’s latest NBN speed report, delivering the fastest average download speeds).

If you’re looking to join the millions of Aussies upgrading to faster NBN, there’s plenty of NBN 50 and NBN 100 options available. We’ve compiled a selection from leading telcos in the tables below.

The following table shows a selection of published cheap NBN 100 plans on Canstar Blue’s database, listed in order of standard monthly cost, from the lowest to highest, and then by alphabetical order of provider. Use our comparison tool to see plans from a range of other providers. This is a selection of products with links to a referral partner.

The following table shows a selection of published cheap NBN 50 plans on Canstar Blue’s database, listed in order of standard monthly cost, from the lowest to highest, and then by alphabetical order of provider. Use our comparison tool to see plans from a range of other providers. This is a selection of products with links to a referral partner.

Share this article