Yet more Aussies are making the jump to faster NBN, with the Australian Competition and Consumer Commission (ACCC) confirming this week that 58% of residential services are now on high-speed connections.

The ACCC’s latest NBN Wholesale Market Indicators Report shows that households have continued to move to fast broadband plans throughout the December 2021 quarter, and more customers are looking to smaller NBN providers for a better deal. The report also suggests that while promotional campaigns to encourage consumers to try out high-speed internet have now ended, many homes are opting to stick with those faster speeds in spite of price changes.

Aussies look to faster plans post-promo prices

The quarterly Market Indicators Report looks at the changes and trends in the wholesale services supplied to NBN providers (that’s telcos such as Telstra, TPG and Optus) by NBN Co. While the report doesn’t cover how plans are then distributed by those telcos to NBN customers, it does provide a good indication of the number and type of NBN plans in use across Australia.

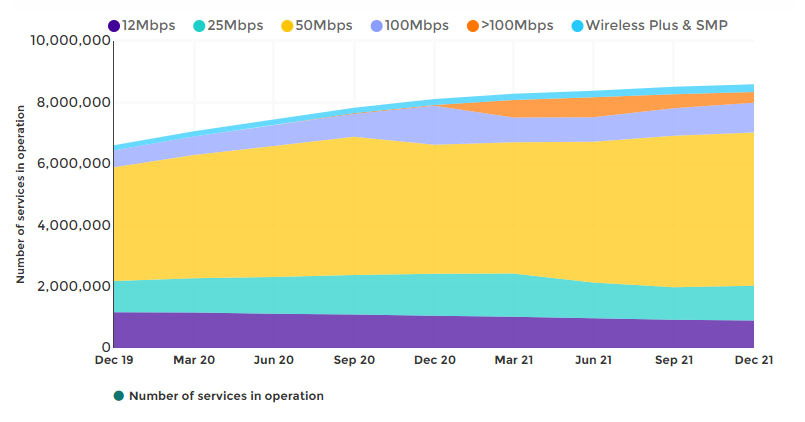

According to the ACCC, almost 8.6 million residential NBN services are now connected. Of those, more than 6.3 million services are on what the ACCC considers ‘high speed’ plans, with maximum download speeds of 50Mbps or faster.

NBN 50 plans accounted for just under 5 million of those connections, with 969,911 homes using NBN 100, and 347,924 connections on plans between NBN 100 and gigabit-speed NBN 1000. Combined, that’s around 73% of residential services on NBN 50 plans and up, with 58% on NBN 50 specifically.

However, very high speed services – those over 100 Mbps – fell over the quarter. Around 108,000 services disconnected or switched to a lower NBN speed tier, meaning about 24% of customers on these plans changed to a cheaper product. This is most likely due to NBN Co’s ‘Focus on Fast’ discounts for those high-speed tiers finally expiring, with customers losing introductory price cuts and finding their broadband bills increasing by anywhere from $10 to $30 per month.

The ACCC points out that, although a large number of customers decided to switch back to slower speeds once limited-time discounts ended, almost half of the homes who moved to a super-fast plan in 2021 have remained on NBN 100 speeds or faster. Overall, affordability remains a significant factor, and ACCC Commissioner Anna Brakey stresses that customers should find a balance between the right NBN speed for their home, and the right price for their budget.

“We encourage consumers to trial new services, but it’s important that they think about their internet usage and choose the speed tier that best fits their needs,” said Ms Brakey.

If you’re looking to join the millions of Aussies now on a faster NBN plan, there’s plenty of NBN 50 and NBN 100 options available. We’ve compiled a selection from leading telcos in the tables below.

The following table shows a selection of published cheap NBN 100 plans on Canstar Blue’s database, listed in order of standard monthly cost, from the lowest to highest, and then by alphabetical order of provider. Use our comparison tool to see plans from a range of other providers. This is a selection of products with links to a referral partner.

The following table shows a selection of published cheap NBN 50 plans on Canstar Blue’s database, listed in order of standard monthly cost, from the lowest to highest, and then by alphabetical order of provider. Use our comparison tool to see plans from a range of other providers. This is a selection of products with links to a referral partner.

Smaller telcos on the rise, big names lose market share

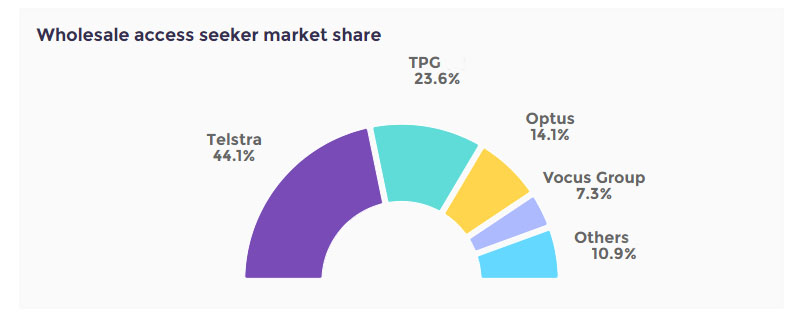

The ACCC’s report also looked at current NBN wholesale market shares – and in good news for the little guys, there’s been an increased presence from smaller providers. Aussie Broadband increased its customer base by about 46,000 over the quarter, and now claims a wholesale market share of 5.6% (just up from 5.1% in the previous reporting period). Fellow smaller operator Superloop also grew, increasing its wholesale market share to 1.7%.

Telstra continues to dominate the NBN market, but did see wholesale shares fall from 44.3% to 44.1% in the December quarter. TPG’s wholesale market share also dropped slightly (down from 23.9% to 23.6%), and Optus went from 14.5% to 14.1%. However, fourth-largest provider Vocus (Dodo and iPrimus) grew from 7.2% to 7.3% in the same period.

While smaller providers may not throw in the same bells and whistles as the bigger brands, they do tend to offer competitive pricing and no-fuss contracts, without the expensive modems and extras often included on plans from Telstra, Optus or Vodafone. Many customers are also now looking to try Australian-owned telcos, or companies with a better reputation for customer service.

“We are glad to see continued growth from smaller NBN providers. Their presence in the market keeps pressure on the big four of Telstra, TPG, Optus and Vocus to maintain a high-quality, competitive service,” said Ms Brakey.

“Some smaller providers are offering consumers different options to meet their specific needs, such as tailored plans and discounted pricing options, network performance graphs, Australia-only call centres and gamer-optimised plans.”

Share this article