Victorians are loyal to the big energy providers despite cheaper deals on offer elsewhere at times, a new industry report has revealed.

The Essential Services Commission (ESC) found there is a ‘striking consumer preference for large retailers’ from brands like AGL, EnergyAustralia and Origin.

Although price still has the biggest impact on consumers when switching energy providers, it seems that other factors are just as important, according to ESC chairperson Kate Symons.

“Having all energy retailers compete on what customers tell us is their main concern – price – is important but building trust by competing on customer experience may also help drive competition and lower prices,” she said.

The ESC report highlighted that large retailers weren’t always focusing on price, but rather improving the brand’s services, which has helped retain customers.

In fact, large electricity brands with a greater market share recorded a much higher customer retention rate over small and medium retailers.

This is despite a number of these small and medium competitors consistently offering cheaper energy prices across Victoria.

Energy customers tend to stick with bigger retailers, even when they might find a better deal elsewhere, our report into the Victorian energy market shows: https://t.co/lokQFK3jBs pic.twitter.com/zyD7PKxfc5

— Essential Services Commission (@EssentialVic) November 30, 2021

While price is central to getting a good deal, other incentives and services shouldn’t be overlooked, Chief Customer Officer at EnergyAustralia Mark Brownfield said.

“Customers tell us that price is important, but equally, they are seeking a retailer they can trust to support them in difficult times and provide options to help reduce their energy use, carbon emissions and save money,” he said.

“We are also proud of how easy it is for customers to get in contact, whether that involves speaking with our contact centre team members or using self-service options.”

Mr Brownfield said a diverse range of services can help Aussies get more out of their power company.

“Often, customers will want to speak with us to make sure their power will be on when they move home, or they need help in understanding their bill. In each case, we are available to help and pride ourselves on being reliable.

“We also work directly with customers when things get tough to help manage their energy costs. Payment plans and extensions are examples, on top of support with energy audits or accessing concessions and government grants they mightn’t know about.”

Does size matter when it comes to energy?

In the Australian energy retail market, there’s no one-size-fits-all scenario, so finding the best value will always come down to the individual needs of a customer.

Tango Energy’s Executive Manager of Growth and Strategy John Ballenger said the industry has evolved and more Aussies are willing to give the smaller guys a go when searching for better deals.

“The market has seen quite a shift over the last five years,” he said. “The biggest three retailers have actually had one million Australians move away from them, while the next tier of retailers have seen their market share double over that same time – evidencing that people are increasingly seeing the value of switching.”

Mr Ballenger claimed smaller retailers in Australia have an edge over the big energy incumbents.

“What people are understanding more and more is that their energy is supplied in the same way, regardless of their retailer, but the smaller providers are far more agile, much more customer focused and provide new innovative products and services at much lower costs.”

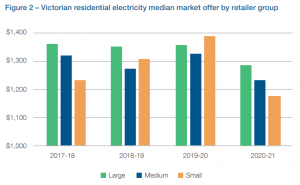

According to the ESC’s report, Tango Energy is a medium electricity retailer with a current market share of between one and five per cent. Median prices between each retailer group are shown below.

Source: Essential Services Commission, Victorian Energy Market Report 2020-21.

What is the difference between large, medium and small retailers?

Large energy retailers are companies that hold more than five per cent of the market share. For example, the following providers are all considered large electricity retailers in Victoria:

- AGL

- EnergyAustralia

- Lumo Energy

- Origin Energy

- Red Energy

- Simply Energy

Meanwhile, medium retailers are brands that hold between one and five per cent of the market share. In Victoria, these companies are:

- Alinta Energy

- Dodo

- GloBird Energy

- Momentum Energy

- Powerdirect

- Powershop

- Sumo

- Tango Energy

All other retailers not categorised as medium or large with a market share of less than one per cent are considered a small energy retailer.

Why are Victorians loyal to bigger energy providers?

The ESC’s report shared that consumers may have some perceptions about the energy market, which could explain their loyalty to the bigger brands. Some of the possible explanations included:

- Choosing a smaller retailer may impact their power supply, although supply risks are usually associated with energy distributors, not retailers.

- Better customer service or experience on offer from large retailers.

- Availability of bundling household utility services, like electricity with gas or internet.

- Greater brand awareness of large or prominent retailers.

Even if Victorians decide to stay with their power company for an extended period of time, don’t expect to be rewarded, Canstar Blue’s Energy Editor Jared Mullane explained.

“There’s often a perception that loyalty will be rewarded, but that’s certainly not the case today,” Mr Mullane said. “If you’ve been with the same provider for a number of years, then chances are you’re paying what’s known as a lazy tax.

“Given how fiercely competitive the Victorian energy market is, don’t be afraid to compare providers on price, but also other features that are important to your needs. Thankfully, Canstar Blue reviews electricity and gas providers each year as rated by Aussie bill-payers, on factors such as bill clarity, customer service, ease of sign-up and environmental sustainability.”

Compare Electricity Providers in Victoria

Image credits: ImageFlow/Shutterstock.com, Duncan Andison/Shutterstock.com

Share this article